Background

Got some spare cash on hand and toying with the idea of buying shares with the fund and seeing what is my gain or loss monthly.

I will be depositing S$500 monthly and maybe more when I got more cash available on hand.

Will it be better than keeping it in SSB or savings account?

I shall use the funds once it is available in my IBKR account and not wait to buy. The reason is that I am trying to avoid timing the market as much as possible, similar to DCA but I will be buying multiple stocks.

Portfolio

The number of Fubo shares increased to 400 as 2 option puts were assigned, The average price is $4.23

My target still remains at 500 shares.

This month I added 40 shares of QYLD. The average price is $18.08

I will be adding more over the next few months or when there are funds available from FUBO options or when QYLD pays out dividends.

The Global X Nasdaq 100 Covered Call ETF (QYLD) follows a “covered call” or “buy-write” strategy, in which the Fund buys the stocks in the Nasdaq 100 Index and “writes” or “sells” corresponding call options on the same index.

Currently, I have a sell put option and if it’s assigned at $2.50 then I would have met my target of 500 shares. I also place 2 sell-call options at $3. The purpose is to do the wheel strategy where I sell options to collect premiums.

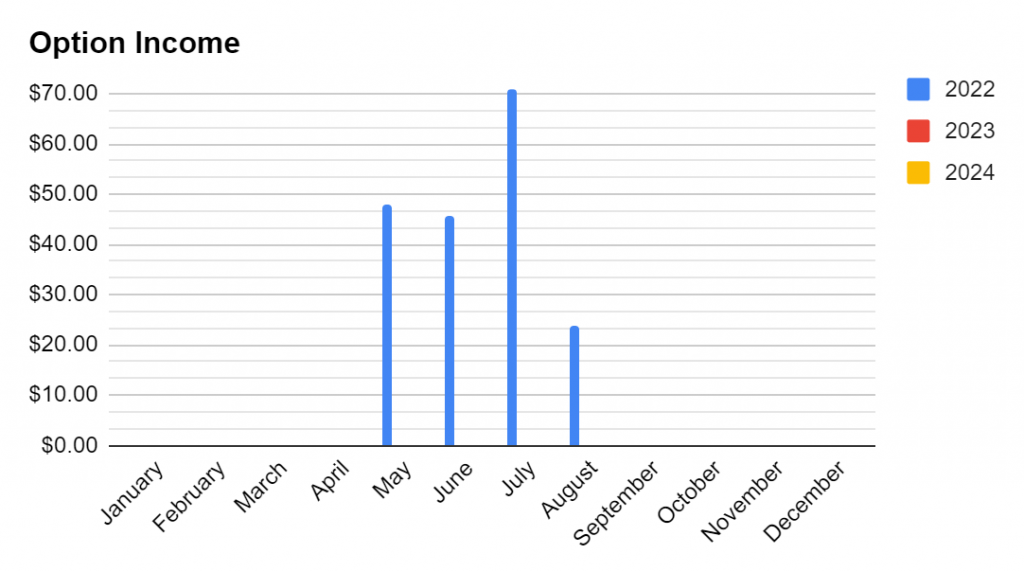

I started doing options for the Fubo shares that I held, can’t let the shares sit down there without doing any job.

To date, I collected USD $188.10 by selling options. The value is approximately 11.13% yield from my cost of purchasing the 400 FUBO shares.

| Month | 2022 | 2023 | 2024 |

| January | $0.00 | $0.00 | $0.00 |

| February | $0.00 | $0.00 | $0.00 |

| March | $0.00 | $0.00 | $0.00 |

| April | $0.00 | $0.00 | $0.00 |

| May | $47.82 | $0.00 | $0.00 |

| June | $45.60 | $0.00 | $0.00 |

| July | $70.89 | $0.00 | $0.00 |

| August | $23.79 | $0.00 | $0.00 |

| September | $0.00 | $0.00 | $0.00 |

| October | $0.00 | $0.00 | $0.00 |

| November | $0.00 | $0.00 | $0.00 |

| December | $0.00 | $0.00 | $0.00 |

| YTD Total | $188.10 | $0.00 | $0.00 |

For those that prefer to see it in the chart