Portfolio

The first month of 2023 ended with my losses at 23%. This is a big increase from last month at over 60%

Mainly contributed by selling my PTON at breakeven cost.

| Ticker | Shares | Current price | Average price | Total Value | Current Value | Gain/Loss |

| FUBO | 500.00 | 2.93 | 4.50 | 2250.00 | 1465.00 | -785.00 |

| QYLD | 154.00 | 16.95 | 17.11 | 2634.94 | 2610.30 | -24.64 |

| SPY | 1.80 | 412.35 | 394.57 | 710.23 | 742.23 | 32.00 |

| BBBY | 100.00 | 3.05 | 6.50 | 650.00 | 305.00 | -345.00 |

| NIO | 100.00 | 11.19 | 12.00 | 1200.00 | 1119.00 | -81.00 |

| ROOT | 5.00 | 7.24 | 200.00 | 1000.00 | 36.20 | -963.80 |

| UPST | 100.00 | 22.10 | 26.50 | 2650.00 | 2210.00 | -440.00 |

| LMND | 100.00 | 18.36 | 23.50 | 2350.00 | 1836.00 | -514.00 |

For the year 2023, I will be adding SPY monthly with my SGD 500. I will also try to increase QYLD to 200 shares before the end of the year. The number of Fubo shares remains at 500 shares. The average price is $4.50

FUBO had hit my target of 500 shares so I will not be adding any more and will be focusing on selling options call for FUBO to collect premiums

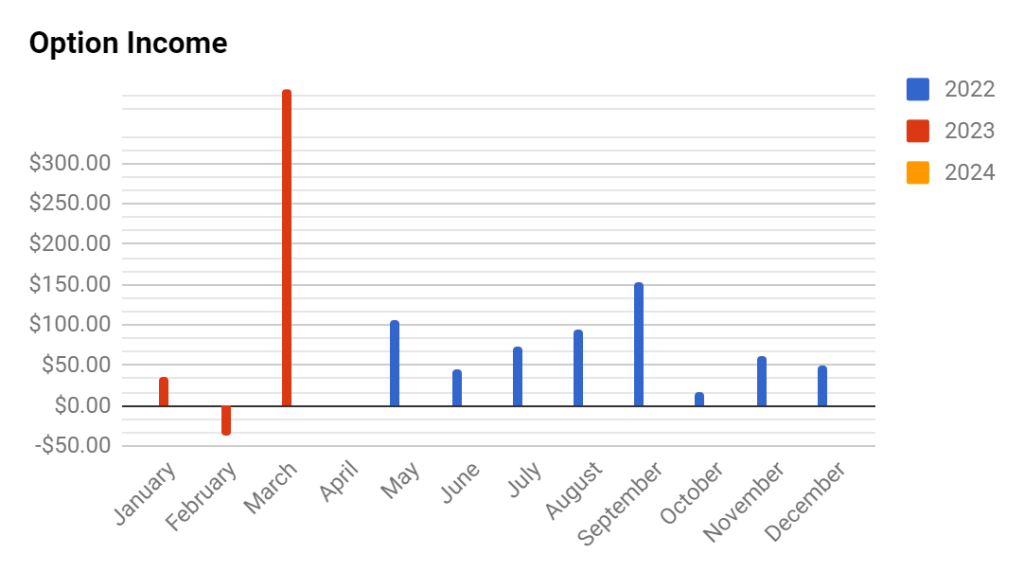

In 2022, I collected USD $598.04 by selling options on IBKR and for 2023, I will be combining the gains I have from IBKR and TD.

| Month | 2022 | 2023 | 2024 |

| January | $0.00 | $34.84 | $0.00 |

| February | $0.00 | -$36.10 | $0.00 |

| March | $0.00 | $391.60 | $0.00 |

| April | $0.00 | $0.00 | $0.00 |

| May | $104.94 | $0.00 | $0.00 |

| June | $45.61 | $0.00 | $0.00 |

| July | $72.76 | $0.00 | $0.00 |

| August | $94.65 | $0.00 | $0.00 |

| September | $152.54 | $0.00 | $0.00 |

| October | $15.73 | $0.00 | $0.00 |

| November | $62.42 | $0.00 | $0.00 |

| December | $49.39 | $0.00 | $0.00 |

| YTD Total | $598.04 | $390.34 | $0.00 |

As of now, the premium I had collected from options is $390.34. The majority of the income is for the month of March as I rolled over some options from January

For those that prefer to see it in the chart