From 1st Jan 2022 to 31st Mar 2022, Citibank Payall facilities is having a promotion that allows you to earn 2 miles per dollar when you charge your cards using Payall to make payment for your bills or invoices.

You can make payment for your taxes, insurance, MCST or education fees which are big tickets items and normally they don’t allow payment using a credit card.

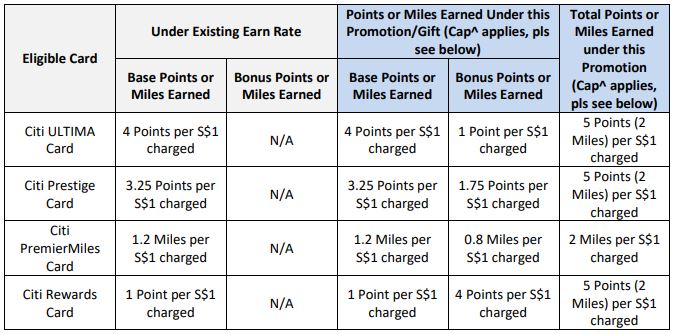

During the promotion period and to be eligible for earning 2 miles per dollar, you will need to make a min total payment of S$3,000 and cap at S$90,000 using Citi Payall. Most Citi credit cards are eligible for this promo including cashback credit cards but you will only earn the base cashback.

Cards that are eligible

- Citi Ultima Card

- Citi Prestige Card

- Citi Premiermiles Card

- Citi Rewards Card

- Citi Lazada Card

- Citi Cash Back Card

- Citi Cash Back+ Card

Note that this promotion is not offered in conjunction with any other Citi PayAll promotions you may be participating in. This means that you will need to pay another bill if you have any recurring payment which was created previously for the previous promo.

Another important will be the charge date has to be within the promotion period.

When will be bonus miles credit to your account

Upon charging the card, you will earn the base points during the spending period

The bonus miles will be credited to you within 12 weeks after the end of the promotion which will be before 23rd June 2022.

Bonus for first time Payall user

If you didn’t make any Payall transactions before, you’ll also get S$50 grab vouchers within 12 weeks from the end of promotion thru SMS and/or email. It will be given in 2 x S$25 denominations and validities for 6 months from the date of issue.

Eligible Cardmembers must also meet the minimum Citi PayAll spend of S$3,000 during the promotion period to qualify for the gift of S$50 in GrabFood vouchers

Summary

For 2 miles per dollar, it is considered a good deal from Citi especially since now people are starting to travel. For cardholders who don’t mind paying 2 cents per mile for the annual fee, this is definitely another option worth looking at.