Portfolio

Advertisements

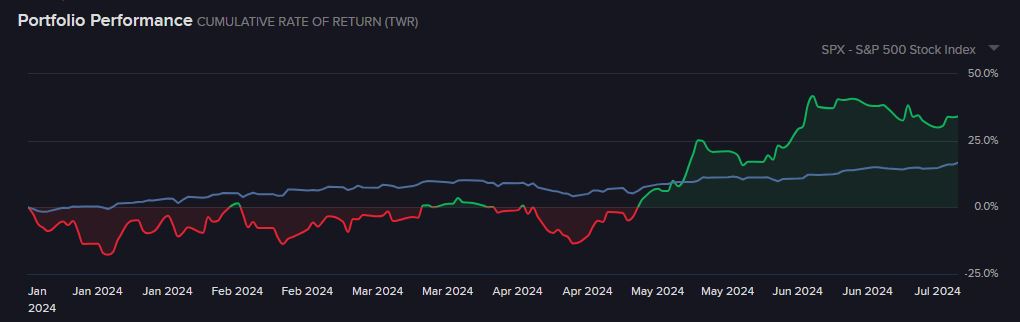

The YTD gain for my account

This month I ended with losses of USD 3779.00.00 based on current unrealized gain/loss.

| Jan 24 | USD (3012.20) |

| Feb 24 | USD (3968.46) |

| Mar 24 | USD (4742.00) |

| Apr-24 | USD (3582.00) |

| May-24 | USD (2612.00) |

| June-24 | USD (3779.00) |

UPST mainly contribute to the losses.

QYLD gained me USD 59.01 in dividends for June

Current shares I am holding

| Ticker | Shares | Current price | Average price | Total Value | Current Value | Gain/Loss | Remarks |

| QYLD | 500 | 17.90 | 17.29 | 8645.00 | 8950.00 | 305.00 | Dividend |

| SPWR | 200 | 2.08 | 3.00 | 600.00 | 416.00 | -184.00 | Options Trade |

| UPST | 200 | 23.20 | 40.25 | 8050.00 | 4640.00 | -3410.00 | Options Trade |

| ARKK | 100 | 45.95 | 33.00 | 3300.00 | 4595.00 | 1295.00 | Options Trade |

| MRNA | 100 | 118.32 | 133.00 | 13300.00 | 11832.00 | -1468.00 | Options Trade |

| NVDA | 100 | 125.83 | 129.00 | 12900.00 | 12583.00 | -317.00 | Options Trade |

In June the total realized gain/loss is as below

| Symbol | Cost Adj. | S/T Profit | S/T Loss | L/T Profit | L/T Loss | Total |

| AI | 0 | 0 | -588.5 | 0.00 | 0.00 | -588.5 |

| MRNA | 0 | 950.46 | 0 | 0 | 0 | 950.46 |

| Total Stocks | 0 | 950.46 | -588.5 | 0 | 0 | 361.96 |

There is a gain from MRNA with USD 950.46 profit

Realized loss for June is USD 588.5 due to AI

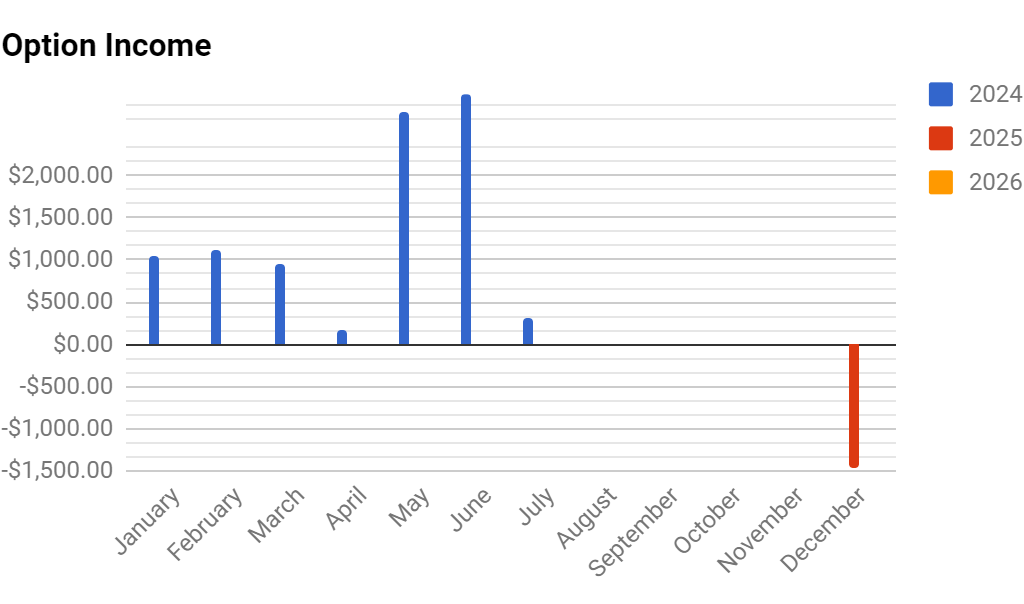

The table below shows my Call/Put options selling gain or losses

| Monthly Option Income per Year | |||

| Month | 2024 | 2025 | 2026 |

| January | $1,040.34 | $0.00 | $0.00 |

| February | $1,125.08 | $0.00 | $0.00 |

| March | $962.30 | $0.00 | $0.00 |

| April | $170.54 | $0.00 | $0.00 |

| May | $2,758.62 | $0.00 | $0.00 |

| June | $2,959.25 | $0.00 | $0.00 |

| July | $306.98 | $0.00 | $0.00 |

| August | $0.00 | $0.00 | $0.00 |

| September | $0.00 | $0.00 | $0.00 |

| October | $0.00 | $0.00 | $0.00 |

| November | $0.00 | $0.00 | $0.00 |

| December | $0.00 | -$1,455.14 | $0.00 |

| YTD Total | $9,323.11 | -$1,455.14 | $0.00 |

For those who prefer to see it in a chart